When China Learns - Auto Edition

China has long been a manufacturing powerhouse, excelling in industries from electronics to textiles. Its ability to produce goods at scale and lower costs has fueled its dominance. However, in industries requiring advanced technology and strong brand recognition, China has historically lagged behind. That is now changing—fast.

Rise of Chinese Automakers

The automotive industry is a prime example of rise of China. In 2019, none of the top 10 global automakers were Chinese. Despite being the world’s largest automotive market, Chinese car manufacturers struggled with quality, technology, and brand perception compared to established international brands.

However, the Chinese auto market has undergone a dramatic transformation in the past five years. Chinese brands have increased their domestic market share from 38% in Aug 2019 to 66% in Aug 2024. The biggest Chinese brand that has experienced explosive growth is BYD. In 2019, BYD delivered ~ 450k cars—now, it surpasses that figure in a single month.

BYD dominates the low-end of the market. The popular BYD Seagull with 300km of range sells for < $10k. With a level of vertical integration surpassing even Tesla, BYD’s cost leadership has put immense pressure on legacy brands like Nissan, Honda, and Volkswagen.

China Learns

For a long time, China’s automotive market was dominated by German and Japanese automakers. Historically, when China master an industry, it often leads to massive expansion, overcapacity, and a brutal survival-of-the-fittest competition. This pattern has played out in consumer goods, solar PV, and now, the automotive sector.

The competition in Chinese auto market is extremely fierce with numerous brands such as BYD, Chery, Geely, GWM, Nio, Leapmotor, etc all vying for dominance. These companies are not only capturing significant domestic market share but are also beginning to export aggressively. The advantages are clear—China’s lower steel prices and labor costs provide a competitive edge over German manufacturers, where labor unions drive up costs. This shift is already evident, with BYD becoming the largest automaker in Singapore and Chinese brands rapidly gaining traction in international markets across Southeast Asia and South America.

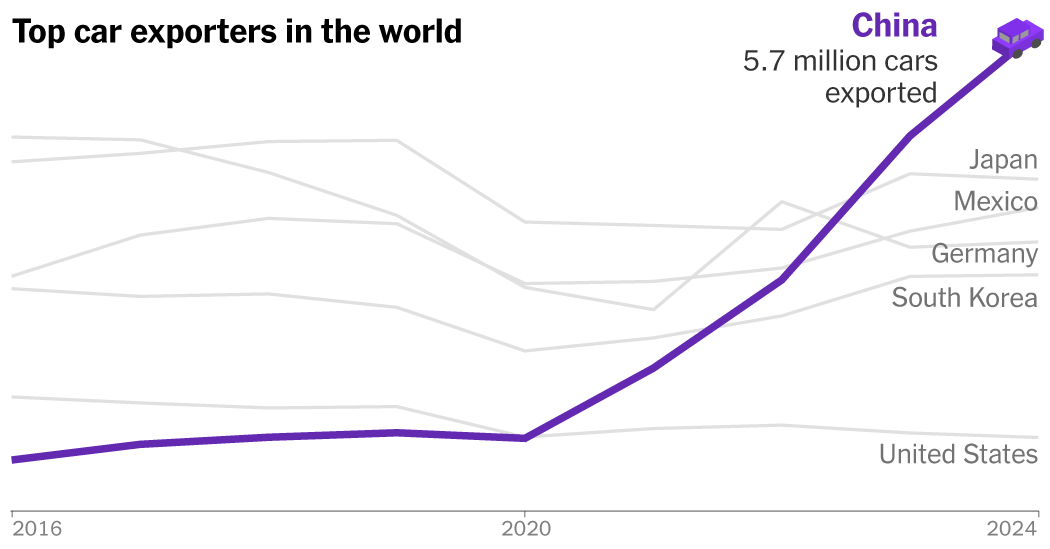

China became the world’s largest auto exporter in 2024. While much of this volume currently comes from legacy brands exporting excess production, Chinese brands are poised to take over this space as well.

Xiaomi’s Foray into Automobiles

I have been fascinated by Xiaomi and their new car SU7. Xiaomi is known for its high-quality affordable smartphones and other consumer electronics. In 2024, they launched their first car – the SU7. SU7 is the perfect combination of great price (~$30k) and impressive features like ADAS and luxurious interiors. Its design is so sleek that it resembles a Porsche, with one Redditor joking that you could rebadge it as a Porsche and sell it for five times the price. Even the CEO of Ford now drives a Xiaomi SU7. This is the high-volume, affordable car embodies the vision many had for Tesla’s mass-market vehicle. The SU7 has the potential to deal a significant blow to upper end of the market domainated by BMW, Mercedes-Benz, Audi, and Tesla.

Changing World Order

The auto industry is a critical pillar of the global economy, particularly for Germany and Japan. China’s rise in this sector will undoubtedly impact these nations. Beyond automobiles, Chinese companies are making rapid advancements in other cutting-edge industries, including chips (Huawei, SMIC), aerospace (Comac), medical devices (Mindray), AI (Deepseek, Qwen), etc.

I want to end with this amazing video by Ray Dalio on Changing World Order.